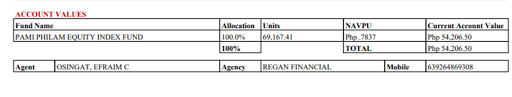

*Cutting off the chase! Showing you the features and the amount of investment (account value of a client's investment) - I featured this coverage to show to you how powerful this investment platform. The photo is shared after getting permission.

|

| Source: Philam Life Portal |

|

| Source: Philam Life Portal |

Years ago, I attended a seminar wherein the lecturer mentioned that life insurance investments cannot be considered as an investment because it has a minimal rate of return. After years of studying, I can finally rebuke what the lecturer talked about and to educate people as well as to why I consider investing in VUL life insurance as the most powerful investment tool that every Filipino family should be capitalizing on.

Let me take this opportunity to show you why investing in Philam Life Insurance is the best investment for your family!

This blog is for the following people:

1. Existing Philam Life insurance holders and those who are contemplating of starting their first investments;

2. Existing investors who are contemplating of lapsing their respective life insurance policies; and

3. People who do not have an idea as to what VULs are.

Read this blog so you'll know why you should start investing in VULs, continue investing in VULs to maximize income and to finish your respective VULs so as not to waste your money, resources, and your time. Here are the things that you will learn

Why Choose Variable Unit Linked Life Insurance (VUL)?

A Mutual Fund - Beefed up

Sample Investment/Insurance Explained

Factors Affecting Cost of Insurance/Investment

Factors Affecting the Level of Investment

Elimination Period

PHILAM LIFE'S CORNER:

Philam Life Insurance Products

How to pay life insurance online?

Set an Appointment

Related: Complete Guide to Owning Life Insurance in the Philippines | EfPrime Financials

Why VUL?

Many do not realize that investing in VULs is the most powerful investment platform that a person can utilize to maximize income. A unit-linked insurance plan (ULIP) is a multi-faceted product issued by insurance companies that combine insurance coverage and investment exposure in a single offering. This product requires policyholders to make regular premium payments, part of which are utilized to provide insurance coverage, while the remaining portions are pooled with assets from other policyholders, then invested in equity and debt instruments, much like mutual funds.1/

The insurance part of a VUL protects people's lives against life's risks which include untimely death, accidents, critical illness, hospitalization, loss of income due to incapacity, and even retiring without money. If something happens to the insured, a sum of money is given to the beneficiaries. Related: What you need to know about insurance

The investment part of VUL is invested in the stock market. In effect, your investment compounds as the underlying public companies grow in economic value. Here are the advantages of investing in VULs:

Investment Enjoys Diversification for decreased risks

Managed by Professional Portfolio Managers

Earns Dividends

Enjoys Capital Appreciation thru compounding

A Mutual Fund - Beefed-up

In effect, what you are buying as an investment is a mutual fund that is stuffed with steroids for optimal benefit to the investor.

It is wrong to think that you will not need an insurance provider because, in reality, we are all exposed to life's risks. No one wanted to get ill, it just happens. If it happens, it will cost a lot of money.

What you need to realize is that having this policy is not a waste of money but has actually comparable returns as what other investment platforms can provide plus you have peace of mind that whatever this life might give, we can overcome.

Sample Investment/Insurance Explained

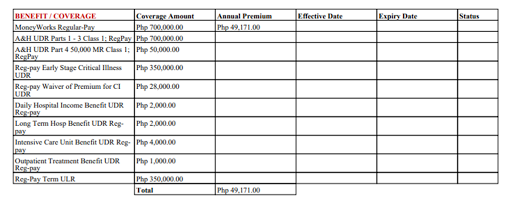

|

| Source: Philam Life Portal |

Each of the coverages shown in the above picture can address life risks which include untimely death of the family provider, accidents that may occur to the insured, critical illnesses that may be diagnosed to the insured, loss of income due to inability to work, high cost of hospitalization and retiring without money, thereby lower your risk of being a victim. Only life insurance investment can solve all life's risks. There is no other financial product present in the market that can solve these risks in one product

|

| Source: Philam Life Portal |

Factors Affecting Cost of Insurance/Investment

These factors greatly affect your earning and your protection from your insurance. Rule of thumb is, the younger a person is, the cheaper is the cost of life insurance and the greater is the earning potential out of the investment portion of the VUL>

Risk Tolerance

This is the amount of risk that a person is wiling to take in realtion to his/her investment

Investment Basket

Philam Life has four (4) investment baskets namely, PAMI Philam Bond Fund, PAMI Philam Fund, PAMI Philam Strategic Growth Fund, and PAMI Philam Equity Index Fund. This four differs as to the amount of risks involve and the projected income that may be earned. The principle is, the higher the risk, the higher the return. Philam Life Equity Inde Fund is the most aggressive of the baskets of Philam Life. The investment is henge to the performance of the Top 30 listed public companies.

Amount of Investment/Investment Period

The higher the amount of investment, the higher is the amount of coverage and withdrawable investment. On the other hand, the longer you invest in the platform, the higher is the rate of return.

Mode of Payment

Your mode of payment likewise affects the amount of your withdrawble investment. The modes of payment can either be, monthly, quarterly, semi-annual or annual payment terms. Annual payment has higher rate of reurn as copared to the monthly payment term because with annual payment terms, the investor has already purchased more number of units. Hence, higher chance of earning in the long run due to capital appreciation.

Age of the Insured

The younger is the investor, the cheaper is the cost of insurance.

Health of the Insured

The healthier the investor is, the cheaper is the cost of insurance. The Other way of seeing it is that, better get start investing in the VUL while you are still healthy so as to enjoy cheaper rates.

Trade-Off Between Insurance Protection and Investment

In VUL insurance, this is the usual trade-off. If you prefer more on the family's protection, there would be a lesser percentage for investment purposes and vice versa. That will be determined in the meeting with the client because there is no one life insurance that can fit all people. Every people has their own life insurance policy that will fit his/her financial condition.

Elimination Period

Newly approved life insurance has the effect of getting the ensured protected by life insurance company i.e. if untimely death occurred, then coverage will be given to the family.

When it comes to life insurance riders (additional protection coverages), insurance companies differ. Different life insurance companies observe different policies as to how long the elimination period will last. In short, the elimination period is the period in which the insurance company will observe the client's whether client insured is true to its declaration. Hence, if the client declared that he has no critical illness but it turned out he was diagnosed with cancer within one (1) month after the approval of the life insurance policy, then the insurance company will not honor the illness as it is within the elimination period.

A tip that I can give you is that, buy a life insurance policy that has a short elimination period to be able to enjoy protection from critical illnesses at the earliest instance. The industry policy with regard to the elimination period is 180 days. or six (6) months. However, for Philam Life Insurance, it will only take 90 days or 3 months.

Enjoy Perks from Owning Life Insurance

Life insurance companies now provide perks for people who purchase life insurances. Gone are the days where life insurance is purely about paying paying paying.

Life insurance companies like Philam Life partnered with Philam Vitality provide perks to life insurance holders as much as PhP200.00 in cash rewards and equivalent on a weekly basis or PhP10,400.00 per year. You can redeem rewards if you do physical exercise. So if you would to analyze, you are not just protecting your life, you are also prolonging your lives due to increased physical activity.

Moreover, you can think that the amount of PhP10,400.00 is a discount to the life insurance premiums that you pay. So if your life insurance premium is PhP30,000 it shall be reduced by PhP10,400.00 that is quite a savings right.

Lastly, aside from the rewards, you will have discounts with partner companies. Read the complete report here.

Term Insurance: Protection Insurances

AIA Critical Protect (ACP) 100AIA All in OneMed AssistGuardian

Variable Unit-Linked Insurance (VUL)

Short Term Pay

Active Health Invest PlusFamily Provider

Long Term Pay

Family SecureMoneyworks Long Term

How to Buy a Philam Life Insurance?

How to Pay Life Insurance Premiums Online?

Conclusion

Get started with investing in VULs now. As you delay your application, the more costly is the cost of your insurance. If you are considering to lapse your policy, then think again because it will be a total waste of resources, loss of income, and most of all a total waste of your time.

Again, Life Insurance is the only investment that you can get on behalf of your family. You can never go wrong in choosing to protect your family. At the end of the day, what you are paying for goes to your investment. There is no money wasted.

Book my services as Financial Advisor. Get Free AIA All In One Life Insurance Quotation.

If you think that the contents of this article helped you in any way. I would appreciate it if you can comment and share my blog with your social media pages especially to your friends, family, and colleagues. Thank you.

You can reach me out in the following social media:

Linked-in: Efraim Osingat, CPA, MBA, RFP

FB Page: Financial Literacy Evolution

Website: efprimefinancials.com

Youtube: EfPrime Financials

All Rights Reserved

Disclaimer

The Author is advising readers to consult with your respective Financial Advisors before venturing in any investments. Investing your money is dependent to your goals and your risk tolerance. You should know the risks and rewards of investing before you actually do the same. The illustrations above are for educational purposes only and any risks or losses that you may incur are imputable to your respective decisions.

The author does not in any way provide a guaranty as to the effectiveness and quality of the products and services that are featured in this blog. The products and services were advertised based on personal experience and product and service reviews that the product/service received.

Want to receive more?

Subscribe to my newsletter and I’ll send you the things that we’ll both love. Just put your information and you’ll be all set. And as always, feel free to unsubscribe or adjust the frequency of mailings.

Subscribe to our Newsletter: Sign up Here

Source: Philam Life

Comments

Post a Comment